Canada Investment Visa: How to Get an Investor Visa in Canada in 2024

Canada is a land of opportunity for entrepreneurs and business owners to expand their business in the international business market.

Low tax rates, a favourably skilled workforce, and Canada’s connection with the US are just some of Canada’s advantages.

The Canada Investment Visa is the most effective pathway to both investing in a growing economy and getting your PR.

In the previous blog, we discussed the top 3 investment visas and their requirements.

Here, our main focus is on a step-by-step walkthrough of what this visa entails, how much you need to invest, and, most importantly, how to improve your application’s success.

What is the Canada Investment Visa?

The Canadian economy has shown great potential and is estimated to have one of the strongest growth rates in 2024 and 2025.

The Canada Investment Visa is a highly competitive program suited for wealthy investors, entrepreneurs, and business owners—a solid path to PR and later Canadian Citizenship.

However, let’s get this straight: You can’t get your Canadian Citizenship directly through this program. You are required to demonstrate that your business is meticulously planned and operate your business in Canada for at least a year.

Canada Investment Visa is also known as the golden visa program and consists of two main categories: the federal investor programs and the provincial entrepreneur programs.

The Federal Investor Programs

The Start-Up Visa program is a federal initiative by Canada that attracts immigrant entrepreneurs who wish to build and grow their businesses.

Do you have the means and innovations to start your own business? Or do you possess the necessary skills to run your business? If so, then this program is well-suited for you.

The provincial entrepreneur programs

Every Canadian province offers both investor and entrepreneur streams. You have to either purchase an existing business or initiate your own business.

However, it should be noted that each province offers different opportunities based on their economic and demographic needs. So, check each province’s criteria thoroughly before making a decision.

How Much Investment is Required for a Canada Investment Visa?

There is no straight answer to this question. Different programs, different financial requirements, right? You may even hear different numbers from different immigration consultant agencies.

However, based on the IRCC’s website, the SUV program requires you to secure a minimum of CAD 75,000 from a designated Canadian angel investor group—or CAD 200,000 from a designated venture capital fund. If you’re accepted into a designated Canadian business incubator program, voila, no funds are needed.

For the Provincial Nominee Programs, investments range from CAD 150,000 to CAD 600,000. The amount primarily depends on the province and the location within the province you’re applying for.

Also, some provinces require a minimum net worth (typically around CAD 300,000).

Sum up these numbers with fees associated with applying for each program and the financial support you and your family need when you arrive in Canada.

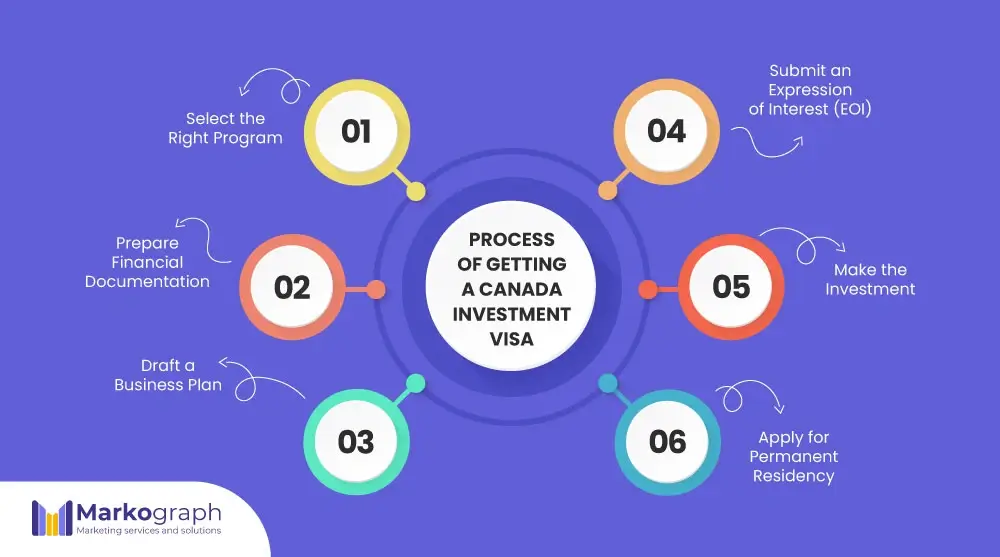

What is the Process to Get an Investor Visa?

Start by choosing the right program—whether it’s a PNP or the Start-Up Visa—that aligns with your business goals, finances, and vision.

Next, gather proof of your net worth, like bank statements, property evaluations, and other financial records.

For many programs, you’ll need a solid business plan that outlines how your venture will contribute to the local economy and create jobs.

If you’re applying for a PNP visa, submit an Expression of Interest (EOI) to highlight your business experience and investment goals. If you’re selected, the province will invite you to apply.

Once approved, finalize your investment as specified by the program, and you’re ready to submit your application for permanent residency in Canada.

SUV VS. Provincial Entrepreneur Programs

Now let’s compare these two Canada investment visa programs and see which of these programs suits you best.

| SUV | Provincial Entrepreneur Program | |

| Eligibility | Must have a qualifying business. You must get a Letter of Support from a designated organization. Must meet language proficiency requirements. Must have sufficient settlement funds. | Your business management experience Personal net worth Language proficiency. You Must intend to live in the province or territory. |

| Investment Requirements | No personal investment is required.Designated organizations must invest at least $75,000 from an angel investor group or $200,000 from a venture capital fund. | Personal investment is required , typically ranging from $200,000 to CAD 600,000, depending on the province. |

| Application Process | Pitch your business idea to a designated organization. Get a Letter of Support and a Commitment Certificate. Apply for permanent residence. You will have the choice to apply for a temporary work permit while waiting for permanent residence. | Submit an Expression of Interest (EOI) to the province. If invited, submit a detailed business plan and application. Obtain a provincial nomination. Apply for permanent residence through the federal government. |

| Limitations | It is limited to businesses that can secure support from designated organizations. Competitive process to obtain support. | Significant personal investment is required. Must meet specific provincial criteria and create jobs. |

| Success Rate | The approval rate for the Start-up Visa Program is approximately 77.2%. | Generally, the PNP has a high success rate due to the nature of the programs that meet provincial needs. |

You must note that the most signifying factor that will influence your rate of success in obtaining a Canada investment visa is a well-planned business plan.

How to Craft a Well-Thought Business Plan

A business plan isn’t just a requirement. It’s your chance to show your business viability to Canadian officers and secure your visa approval. A well-structured business plan should have the following structure.

1- Executive Summary

This opening section should provide a brief overview of your business idea. What is your product or service? Give details about your company’s whereabouts and managers and staff.

2- Company Description

Talk about what your business does and how it will meet the market needs. How is your business any different from your competitors? Include your business structure (e.g., LLC, corporation)

3- Market Analysis

You have to show that you’ve conducted thorough research to identify market opportunities.

4- Organization and Management

Outline how your business is organized. Talk about who owns the company, the management team, and any board members. Give some background on the leadership team and their skills.

5- Product or Services

Now’s the time to talk about what you are offering in great detail. How will your products or services benefit customers? Mention the product lifecycle and any plans for further development.

6- Marketing and Sales Strategy

What is your marketing strategy? How are you going to attract customers and keep them coming for more?

Talk about your sales tactics, and make sure you partner up with a professional digital marketing agency that is familiar with local Canadian markets.

7- Funding Request and Financial Projections

If you’re looking for funding, outline exactly how much you need now and might need over the next few years.

Detail how the money will be used to grow the business and explain your income and cash flow statements for the next three to five years.

How Markograph Can Boost Your Chances of Getting an Investor Visa

Starting a business is no small feat. You’ve got the vision, the grit, and a standout product. But how do you make sure your business doesn’t just survive but actually thrives in Canada’s crowded market? Without a solid marketing strategy, even the best ideas can struggle to take off.

That’s where Markograph steps in. They offer customized marketing solutions like SEO, performance marketing, and retention strategies that fit your industry.

In a busy marketplace, standing out is key. With Markograph’s data-driven approach, you can make sure your business gets the visibility it deserves.

Wrapping Up

So far, we’ve talked about different types of Canadian investment visa programs and compared them to one another. Whether you choose SUV or Provincial Entrepreneur Programs, it’s important to craft the best business plan to increase your chance of visa approval and the success of your business.

Markograph is here to offer personalized strategies based on your business plan and ensure your company thrives in Canada’s marketplace.

FAQ

1- What is the Canada Investment Visa?

It’s a program that allows entrepreneurs and investors to gain permanent residency by investing in a Canadian business.

2- How much investment is required for a Canada Investment Visa?

The amount varies by program, typically between CAD 75,000 and CAD 600,000, depending on the program and province.

3- How do I increase my chances of getting a Canada Investment Visa?

A well-planned business plan, securing a letter of support, and demonstrating industry expertise can improve your application.

4- Which is better: the SUV or the Provincial Entrepreneur Program?

The best program depends on your business type, investment level, and whether you prefer a federal or provincial pathway.